California Net Pay Calculator 2024: Estimate Your Paycheck Now!

Are you tired of deciphering the cryptic language of pay stubs, wondering where your hard-earned money actually goes? Understanding your net pay in California is crucial for managing your finances, budgeting effectively, and ensuring you're receiving what you deserve.

Calculating your net pay the amount you actually take home after all deductions can feel like navigating a complex maze. This is especially true in California, where a multitude of factors influence your paycheck, from state and federal income taxes to Social Security, Medicare, and potentially local taxes. Understanding these elements is essential to making informed financial decisions.

The following table presents the key aspects of California's net pay calculation. It highlights various factors which affect your take-home earnings.

- Anna Faris Michael Barrett A Secret Knot Blended Family

- Deepfake Warning Exploring Sensitive Content Ai Ethics

| Category | Details | Impact on Net Pay |

|---|---|---|

| Gross Pay | Total earnings before any deductions. Includes salary, hourly wages, overtime, commissions, and bonuses. | Forms the base for all deductions. Higher gross pay generally leads to higher net pay, but the relationship isn't linear due to tax brackets. |

| Federal Income Tax | Withheld based on your W-4 form and the IRS tax brackets. The amount depends on your income level, filing status, and any claimed deductions or credits. | Significantly reduces net pay. The percentage withheld increases as your income rises, following progressive tax rates. |

| California State Income Tax | Withheld based on your W-4 form and California's tax brackets. Similar to federal tax, the amount depends on your income, filing status, and any applicable deductions. | Reduces net pay. California has its own progressive tax system, meaning higher earners pay a larger percentage of their income in taxes. |

| Social Security Tax | A mandatory deduction of 6.2% of your gross earnings up to a certain income threshold ($168,600 in 2024). | Decreases net pay. This tax funds the Social Security program, providing benefits to retirees, the disabled, and survivors. |

| Medicare Tax | A mandatory deduction of 1.45% of your gross earnings. An additional 0.9% is withheld for wages exceeding certain thresholds ($200,000 for single filers, $250,000 for married filing jointly). | Reduces net pay. This tax funds the Medicare program, providing health insurance to individuals over 65 and those with disabilities. |

| Pre-Tax Deductions | These reduce your taxable income before calculating federal and state taxes. Examples include contributions to 401(k) plans, health insurance premiums, and flexible spending accounts (FSAs). | Generally increases net pay, as they reduce the amount of income subject to taxes. |

| Post-Tax Deductions | These are taken out of your pay after taxes have been calculated. Examples include union dues, Roth 401(k) contributions, and after-tax health insurance premiums. | Reduces net pay, as these are deducted from your take-home pay after taxes. |

| Local Taxes (If Applicable) | Some California cities and counties impose local income taxes or other taxes. | Further reduces net pay, depending on the specific local tax rates and regulations. |

For an in-depth understanding of California's tax system, you can refer to the official website of the California Franchise Tax Board (FTB).

Calculating your net pay involves a series of steps, each critical to accuracy. First, determine your gross pay. If you're paid hourly, multiply your hourly rate by the number of hours worked. If you're salaried, this is your annual salary divided by the number of pay periods (e.g., bi-weekly, monthly). Next, calculate all deductions from your gross pay. This will involve determining federal income tax, California state income tax, Social Security tax, Medicare tax, and any pre-tax or post-tax deductions. Subtract the total deductions from your gross pay to arrive at your net pay.

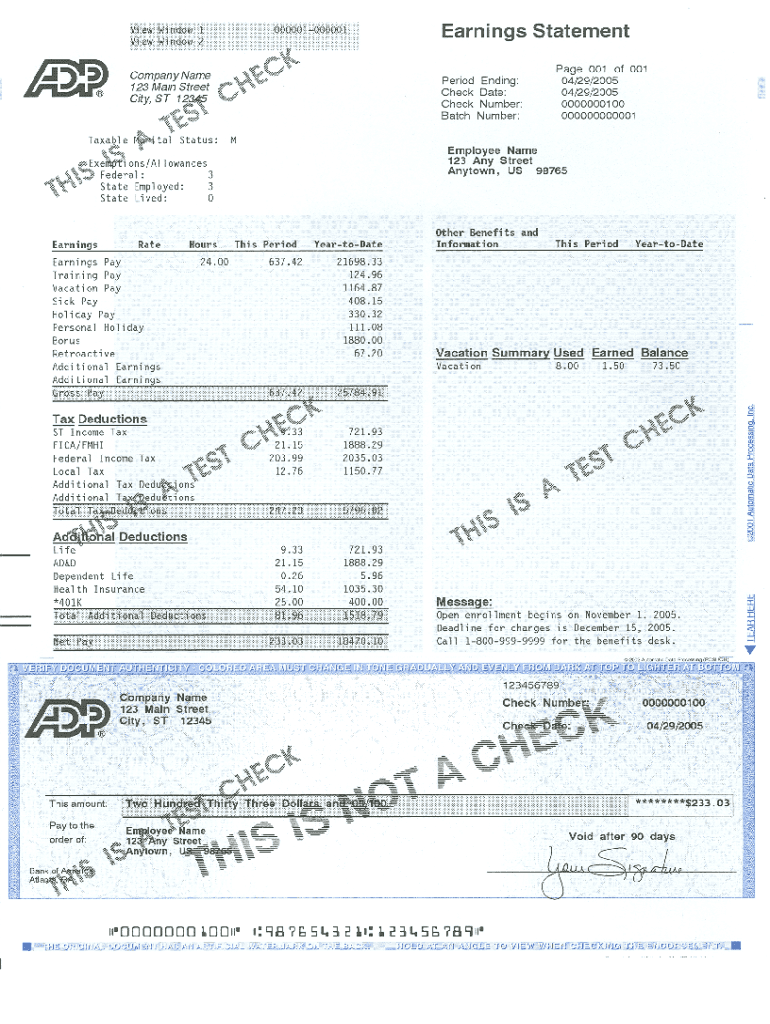

Several tools can help simplify the net pay calculation. Online paycheck calculators, such as those offered by ADP or Roll, allow you to enter your gross pay, W-4 information, and other relevant details to estimate your net pay. These tools are particularly useful for quickly calculating your take-home pay. Remember to always use official government sources or consult with a tax professional for precise figures and advice.

Understanding the impact of federal and state taxes is essential. Federal income tax rates are determined by the IRS, with rates varying based on your income level and filing status. Similarly, California has its own progressive tax rates. It is crucial to be aware that changes in tax laws at either the federal or state level can significantly affect your take-home pay. For instance, any update in tax brackets, tax credits, or deductions will directly influence the amount withheld from your wages.

Social Security and Medicare taxes are mandatory deductions that contribute to essential social programs. Social Security tax is a flat percentage of your income up to a certain threshold, while Medicare taxes apply to all earnings. Note the additional Medicare tax for high-income earners, which further reduces net pay for those earning above the specified thresholds.

Beyond the basic deductions, pre-tax and post-tax deductions can significantly impact your net pay. Pre-tax deductions, such as contributions to a 401(k) or health insurance premiums, reduce your taxable income, potentially lowering your overall tax liability. Conversely, post-tax deductions are taken from your net pay after taxes have been calculated.

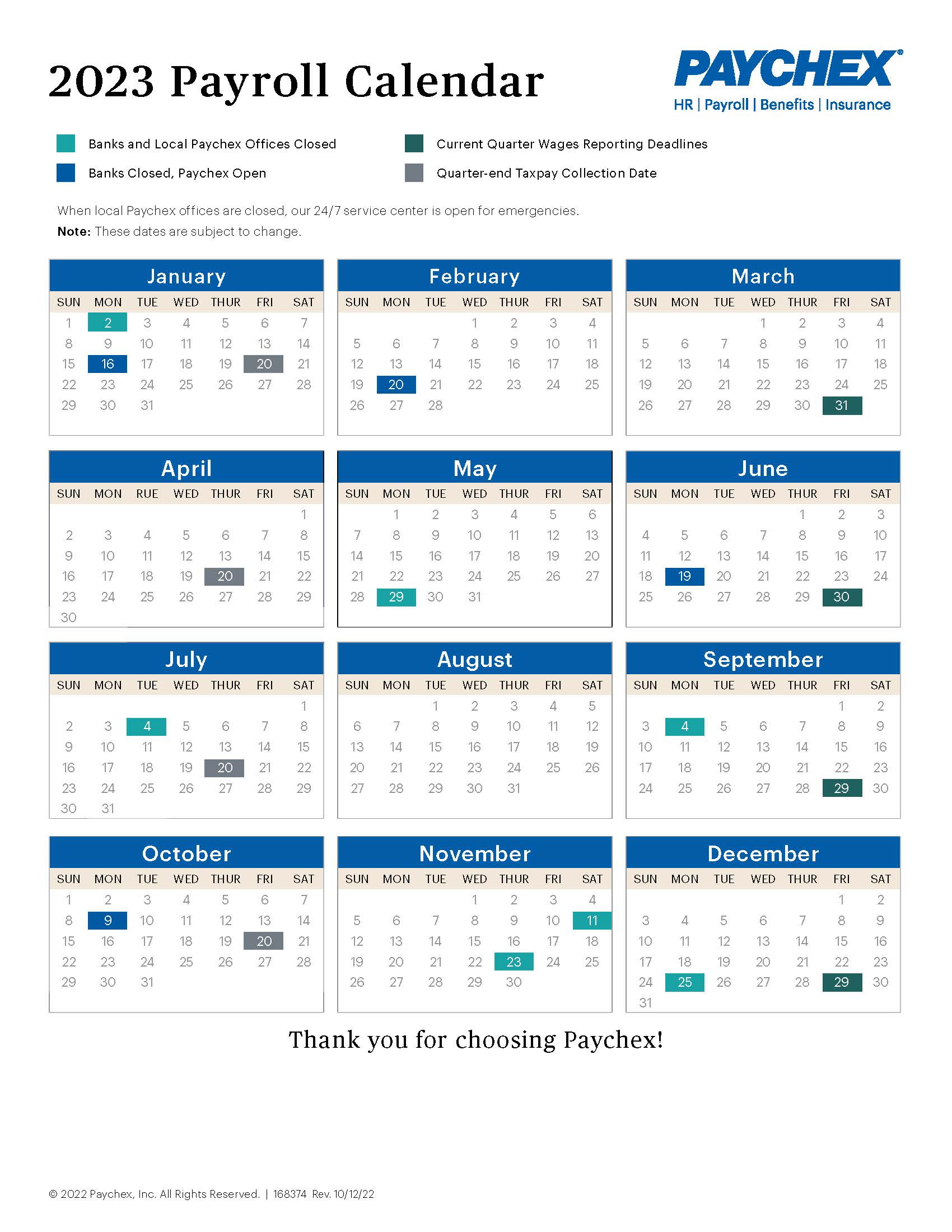

The frequency of your pay cycle also influences how you perceive your net pay. Whether you are paid weekly, bi-weekly, semi-monthly, or monthly affects the size of each paycheck. While your annual net income remains the same regardless of the pay frequency, the amount you receive in each pay period varies.

For those working in California government, changes to federal income tax withholding are reflected in payroll. Keeping abreast of these adjustments ensures you are aware of how your take-home pay may be affected. Consult your human resources department or payroll administrator for details on how these changes impact your specific situation.

The IRS offers a tax withholding estimator to help you determine the correct amount of federal income tax to be withheld from your paycheck. Using this tool, and reviewing your W-4 form periodically, ensures you are not overpaying or underpaying your taxes throughout the year.

While many online calculators are available, it is important to remember that these are for general guidance and estimations. They cannot calculate precise taxes or financial data. If you require accuracy in financial planning or need an exact calculation, consult with a qualified tax professional or accountant.

Several online resources, such as ADP's Arizona paycheck calculator, offer the capability to estimate net pay. The process is made simple by entering your wages, tax withholdings, and other required information.

In addition to federal and state income taxes, other factors influence your paycheck. These factors may include local taxes. You can use online tools to determine the impact of these taxes. They will help you understand your overall tax burden.

Payroll tax modeling calculators can provide a comprehensive view of all deductions, including federal, state, and local taxes, as well as benefits and other deductions. These tools can be valuable for financial planning and understanding your full financial picture.

California's monthly salary calculator is frequently updated with the latest income tax rates. It is a convenient tool for calculating your income tax and salary after tax based on your monthly income. This calculator can be utilized across various devices.

The gross pay in the hourly calculator is determined by multiplying the hours worked by the hourly rate. You can also add multiple rates to calculate gross pay accurately.

Remember, these resources should not be used for tax or legal advice. Always consult with qualified professionals.

The ADP California paycheck calculator simplifies the process of calculating net pay. It takes into account taxes, deductions, and financial obligations to offer a clear picture of an employee's take-home pay. Both employers and employees benefit from the clarity this provides.

Detail Author:

- Name : Sonny Zieme

- Username : wiza.kathleen

- Email : altenwerth.treva@yahoo.com

- Birthdate : 1986-04-26

- Address : 7871 Schneider Island Apt. 953 Wittingstad, AK 89366

- Phone : +1-928-864-4575

- Company : Howe-Emmerich

- Job : Elevator Installer and Repairer

- Bio : Iste eos rem tempore aut a. Saepe eos odit quaerat in voluptate vel ratione. Aut aut veniam corporis nisi accusamus officiis voluptas. Consequatur itaque dolores nisi hic aliquid non sed.

Socials

linkedin:

- url : https://linkedin.com/in/kobe.bashirian

- username : kobe.bashirian

- bio : Quos laudantium consequatur nihil.

- followers : 4915

- following : 1192

tiktok:

- url : https://tiktok.com/@kobe_real

- username : kobe_real

- bio : Et ab officia rerum sunt ut quibusdam. Et ipsa optio deserunt.

- followers : 5224

- following : 1868