Retirement Planning: Get Started Now With Our Guide & Tools!

Are you prepared for retirement? Many individuals significantly underestimate their financial needs for their golden years, potentially leading to considerable struggles later in life.

The pathway to a comfortable retirement is often paved with careful planning and diligent saving. One of the first, and most crucial, steps involves accurately assessing how much you'll need to maintain your desired lifestyle. This understanding forms the bedrock of a sound retirement strategy, allowing you to take proactive steps to secure your financial future. Fortunately, a range of tools and resources are available to help individuals navigate this complex landscape. Among these, investment calculators stand out as particularly valuable aids, empowering users to take control of their savings and make informed decisions.

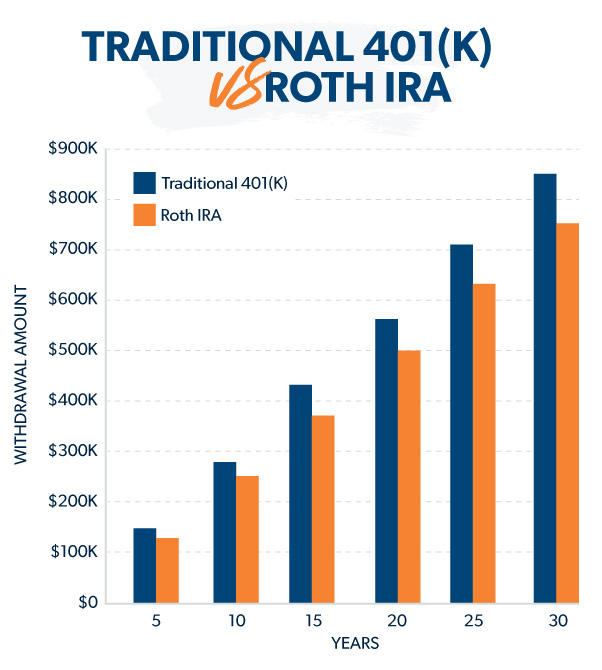

The process of building a secure retirement nest egg involves understanding the different vehicles available for saving and investing. Two primary types of retirement accounts are widely utilized in the United States: the Traditional IRA and the Roth IRA. Both offer distinct advantages, with the choice between them often depending on an individual's current financial situation and future tax outlook. The Traditional IRA offers tax benefits upfront, with contributions potentially tax-deductible in the year they're made. The Roth IRA, on the other hand, provides tax-free growth and withdrawals in retirement, making it an appealing option for those who anticipate being in a higher tax bracket later in life.

- Derivatives Cheat Sheet Your Calculus Quick Reference Guide

- Alternatives To Apoquel For Dogs Relief Amp Options Explained

| Key Features | Traditional IRA | Roth IRA |

| Tax Treatment of Contributions | May be tax-deductible in the year made, reducing taxable income. | Contributions are made with after-tax dollars; no tax deduction in the contribution year. |

| Tax Treatment of Earnings | Earnings grow tax-deferred; taxes are paid upon withdrawal in retirement. | Earnings grow tax-free; withdrawals in retirement are tax-free. |

| Tax Treatment of Withdrawals | Withdrawals in retirement are taxed as ordinary income. | Withdrawals in retirement are generally tax-free. |

| Contribution Limits (2024) | $7,000 ($8,000 if age 50 or older) | $7,000 ($8,000 if age 50 or older) |

| Income Limits for Contributions | May be subject to income limitations for tax-deductibility of contributions. | Subject to income limitations for eligibility to contribute. |

In addition to IRAs, employer-sponsored 401(k) plans play a significant role in retirement savings. These plans offer various benefits, including potential employer matching contributions and a convenient way to save through payroll deductions. Moreover, 401(k)s often provide a wider range of investment options compared to IRAs. It's a government tax break to incentivize people to invest money for retirement.

One of the most valuable tools available to prospective retirees is an investment calculator. This tool helps users estimate potential investment growth over time based on various inputs, such as initial investment amount and monthly contributions. By inputting these figures, users can gain a clearer picture of how their investments might grow over time. This empowers individuals to make informed decisions about their saving and investment strategies. The Ramsey Investment Calculator, provided by personal finance expert Dave Ramsey, is a free online tool widely utilized by individuals seeking to assess their retirement readiness. It allows users to project their portfolio growth, helping them set realistic financial goals.

Dave Ramsey, a well-known figure in the personal finance world, emphasizes the importance of disciplined saving and investing. His work resonates with many who are looking to improve their financial standing, his advice and the tools he provides are a guiding light for those seeking financial freedom and security. His methods, often characterized by a "baby steps" approach, focus on debt reduction, consistent saving, and strategic investing. In his bestselling book, "Baby Steps Millionaires," Dave shares the stories of real people who had average incomes but still became millionaires because of their actions and habits the same actions and habits that can make you a millionaire too!

- Explore Jin Goo The South Korean Actors Journey Facts

- Fact Check Maxwell Yearick Trump Rally Shooting Claims Debunked

The Roth IRA stands out as a "rock star" of retirement plans. It allows you to invest in the best mutual funds, and you wont have to pay taxes on the growth in the account when you use it in retirement. This makes the Roth IRA a powerful tool for long-term financial planning. You can also consider using a 529 plan. A 529 plan (named after its section of the IRS tax code) is an investment account that allows you to set money aside for qualified educational expensesthink things like tuition, fees, books, and room and board.

While most workers are limited to Roth IRA contributions of $6,500 per year as of 2023, if youre 50 or older, you can bump that up by $1,000 per year, to $7,500. For 2024, the total amount you can contribute to either a traditional or Roth IRA is $7,000 ($8,000 if youre 50 or older). This can have a significant impact on your overall retirement savings.

Consistent investing means making regular contributions to your investment accounts, regardless of market conditions. This approach, often referred to as dollar-cost averaging, helps to mitigate risk and take advantage of market fluctuations. By investing regularly, you buy more shares when prices are low and fewer shares when prices are high, smoothing out your returns over time. Over the long term, this can significantly boost your portfolio growth.

Understanding the tax implications of retirement savings is also crucial. In the U.S., the traditional IRA and Roth IRA are also popular forms of retirement savings. Only distributions are taxed as ordinary income in retirement, during which retirees most likely fall within a lower tax bracket. However, 401(k) savings are different. Those withdrawals will count as taxable income. And if your retirement income puts you in the 12% tax bracket, that means youd actually have to withdraw around $28,200 from your 401(k) every year to cover your taxes and still get the income you need.

Here are some factors to consider when calculating retirement needs:

- Estimate Your Expenses: Determine how much you currently spend annually and adjust for any expected changes in retirement.

- Consider Inflation: Factor in the rising cost of goods and services over time.

- Assess Healthcare Costs: Healthcare expenses often increase in retirement; consider potential costs for insurance and medical care.

- Project Investment Returns: Estimate the returns your investments are expected to generate.

- Account for Longevity: Plan for a longer lifespan than you might expect.

- Seek Professional Advice: Consult with a financial advisor for personalized guidance.

The cost of living varies greatly depending on your desired retirement location. Youll need a lot more money if youre going to retire in Manhattan versus Little Rock, Arkansas! Make sure that you are well aware of the cost of living and consider that in your financial planning.

Before you start withdrawing money from your retirement account, its important to plan it out, you will need to be very particular about the seven steps for withdrawing money from your retirement account once you've retired:

- Determine Your Expenses: Calculate your monthly living expenses in retirement.

- Assess Your Assets: Inventory your retirement savings, investments, and other assets.

- Calculate Your Withdrawal Rate: Determine the percentage of your savings you can safely withdraw each year.

- Prioritize Tax Efficiency: Consider the tax implications of withdrawals from different accounts.

- Monitor Your Portfolio: Regularly review your investments and adjust your strategy as needed.

- Plan for Healthcare: Factor in the rising cost of healthcare.

- Consult a Financial Advisor: Get professional advice to create a sustainable withdrawal strategy.

The retirement investment guide you need to be successful involves various factors, the earlier you start and the more consistent you are, the more likely you are to achieve your retirement goals. Don't forget that the amount you invest each month is one of the most important factors.

| Financial Tools and Resources: | Description |

| Ramsey Investment Calculator | A free online tool to estimate potential investment growth, initial investment and monthly contribution. |

| Retirement Calculators | Tools that helps users calculate their retirement needs. |

| 401(k) Calculator | Used for more information about 401(k)s |

| Roth IRA Calculator | To find out more about the Roth IRA plan |

| Annuity Payout Calculator | To determine the amount of annuity that you will get. |

To summarize, adequate retirement planning involves a thorough understanding of your financial needs, a diversified savings strategy, and a willingness to make adjustments as life circumstances evolve. By utilizing available resources and seeking professional advice, individuals can take significant steps towards securing a financially stable and fulfilling retirement.

Detail Author:

- Name : Amari Langosh

- Username : littel.kane

- Email : lawrence74@dickens.com

- Birthdate : 1984-03-24

- Address : 7014 Jody Points New Colemanstad, AL 33149

- Phone : 1-629-483-8945

- Company : Kuphal-Stehr

- Job : Civil Engineer

- Bio : Earum et vel et et eum laboriosam nihil qui. Et quam voluptatem nostrum reprehenderit ipsa porro. Cupiditate cumque in labore et quos.

Socials

twitter:

- url : https://twitter.com/ebertd

- username : ebertd

- bio : Est laudantium ad dolor et aut occaecati. Voluptates voluptatem beatae est quam consequatur itaque aut. Amet inventore consequatur odio aut quo.

- followers : 3545

- following : 573

facebook:

- url : https://facebook.com/ebert1985

- username : ebert1985

- bio : Rem et ex et commodi error nesciunt. Earum sed cumque nesciunt eaque et.

- followers : 5784

- following : 2895