California Paycheck Calculator 2025: Estimate Your Net Pay

Are you truly aware of the considerable impact California's tax system has on your take-home pay? Understanding the nuances of state and federal taxes is not just a financial necessity; it's the bedrock of effective budgeting and financial planning, especially when navigating the economic landscape of the Golden State.

In the heart of California, where the sun-kissed beaches meet bustling cityscapes, residents often find themselves grappling with a complex web of taxes. The state, renowned for its progressive income tax system, boasts the highest top marginal income tax rate in the nation. This means that high earners contribute a larger percentage of their income to state coffers. But how does this intricate system affect your personal finances? Let's delve into the details.

To put it simply, the California paycheck calculator is an essential tool that can clarify your tax situation, offering you an estimated breakdown of potential tax liabilities. Whether you're an hourly worker or a salaried professional, knowing your take-home pay, after accounting for federal, state, and local taxes, is crucial. This awareness is the first step in managing your finances effectively, helping you make informed decisions about savings, investments, and overall financial well-being.

- Marion In Remembering Oct 13 2022 Web Administrator Local News

- Easy Wine Bottle Label Removal Tips Tricks You Need

Consider the story of Sarah, a software engineer living in San Francisco. Initially overwhelmed by the intricacies of California's tax system, she found solace in using a reliable paycheck calculator. By inputting her salary and withholding information, Sarah gained a clear picture of her net pay, the deductions for federal and state taxes, social security, and Medicare. This newfound clarity empowered her to plan her budget, save for a down payment on a home, and make smart investment choices.

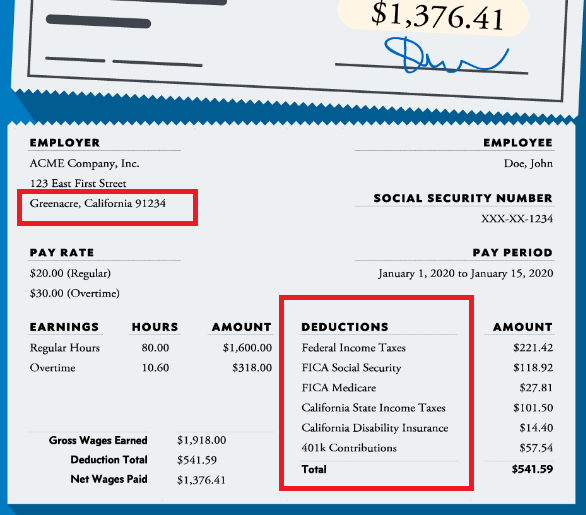

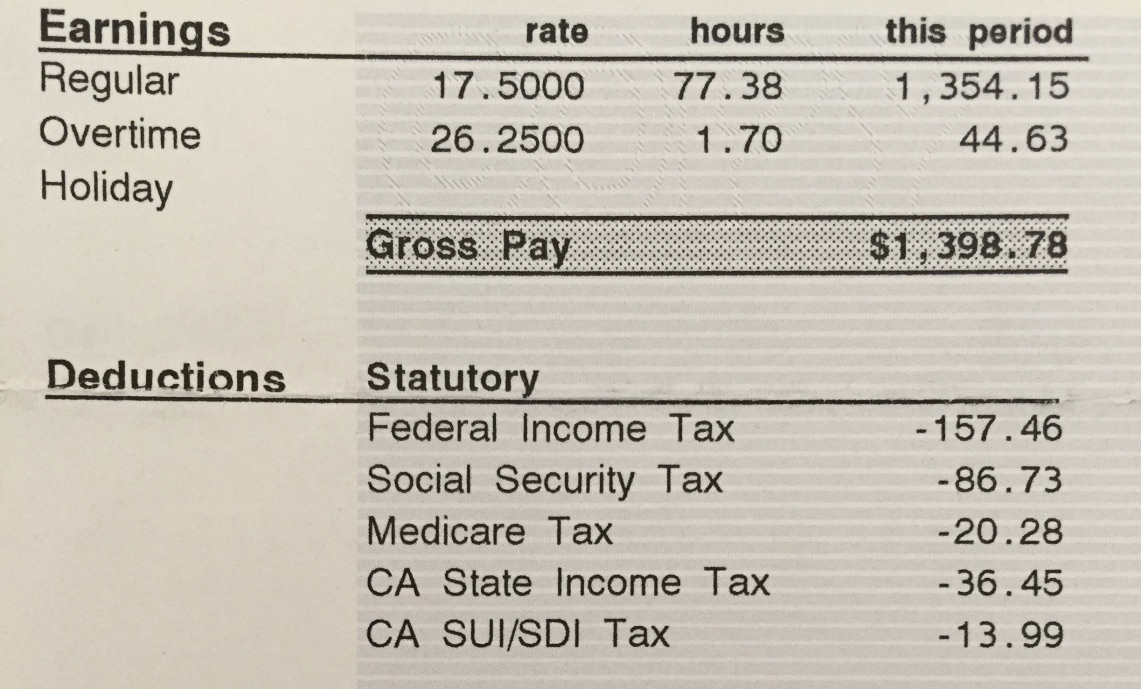

The key lies in understanding the components of your paycheck. When calculating your net pay, or "take-home" pay, several factors come into play:

- Gross Pay: This is the total amount you earn before any deductions are applied. It includes wages, salaries, tips, bonuses, and any other form of compensation.

- Federal Income Tax: Unless exempt, employees are obligated to pay federal income tax. All sources of income, from wages to bonuses, are subject to this tax.

- State Income Tax: California's progressive income tax system dictates the rates, which range from 1% to 13.3%, depending on your income level. The higher your earnings, the greater the percentage you pay.

- Social Security Tax: This tax is set at 6.2% of earned income up to a certain threshold, currently $147,000. The maximum social security tax for employees is $9,114.

- Medicare Tax: At 1.45%, this tax applies to all earnings. There's also an additional 0.9% Medicare tax for earnings above $200,000 for single filers, $250,000 for married filing jointly, or $125,000 for married filing separately.

- Other Deductions: These can include contributions to retirement accounts like Roth 401(k)s and other pre-tax benefits.

The 2024 California state income tax rates, as of the time of this writing, fall within the range of 1% to 13.3%, a critical figure when calculating your estimated take-home pay.

- Shelley Duvalls Dr Phil Interview Fallout Legacy News

- Agnes Mooreheads Home A Look Back Google Discover

The use of online tools and resources becomes invaluable in the process. For instance, Smartasset's California paycheck calculator, and those provided by ADP and Oysterlink, provide easy ways to input wages, tax withholdings, and other required information. These tools then take care of the complex calculations, giving you an estimate of your net pay after all deductions.

The golden states income tax system is progressive, a term youll likely encounter repeatedly as you engage with your finances in California. This system is designed to make higher earners pay a higher marginal tax rate on their income. The implication of this is simple: your income level greatly influences your take-home pay. For example, two individuals may have the same gross salary, but the difference in their income can lead to significantly different net pay outcomes, owing to variations in tax bracket.

The annual salary calculator, frequently updated with the latest income tax rates, is a useful tool to determine income tax and salary after tax based on annual income. These calculators are often designed for use on various devices, from mobile phones to desktop computers and tablets, ensuring accessibility for all.

Keep in mind that the details provided in this article are for general informational purposes only. Always consult with a qualified tax advisor or financial planner for personalized guidance tailored to your specific circumstances. They can help you navigate the tax system, maximize deductions, and make informed financial decisions.

For the 2025 tax year, remember the filing thresholds. You must file a return if you're single and earning more than $15,000, or married and filing jointly if you earn more than $30,000. Staying on top of these deadlines is crucial to avoid penalties.

Beyond the paycheck calculator, there are other resources. Related income tax and budget calculators assist with financial planning. They provide a visual framework for budget planning, especially during a time when prices are ever-changing. This helps you to estimate your expenses and savings goals. These can be incredibly helpful for anyone trying to get a handle on their finances in California.

You must withhold federal income tax from employees pay, unless they are exempt. These taxes must be paid on all wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits. Remember, understanding these taxes is key to your financial health and well-being.

Many states have no income taxes (such as Alaska, Texas, Florida, Nevada, and Washington), while others, like California and New York, impose high state income taxes on employee earnings, which can result in smaller net paychecks.

Detail Author:

- Name : Amari Langosh

- Username : littel.kane

- Email : lawrence74@dickens.com

- Birthdate : 1984-03-24

- Address : 7014 Jody Points New Colemanstad, AL 33149

- Phone : 1-629-483-8945

- Company : Kuphal-Stehr

- Job : Civil Engineer

- Bio : Earum et vel et et eum laboriosam nihil qui. Et quam voluptatem nostrum reprehenderit ipsa porro. Cupiditate cumque in labore et quos.

Socials

twitter:

- url : https://twitter.com/ebertd

- username : ebertd

- bio : Est laudantium ad dolor et aut occaecati. Voluptates voluptatem beatae est quam consequatur itaque aut. Amet inventore consequatur odio aut quo.

- followers : 3545

- following : 573

facebook:

- url : https://facebook.com/ebert1985

- username : ebert1985

- bio : Rem et ex et commodi error nesciunt. Earum sed cumque nesciunt eaque et.

- followers : 5784

- following : 2895