California Paycheck Calculator: Get Your Take-Home Pay!

Are you grappling with the complexities of California's payroll system, wondering how much of your hard-earned money actually makes it into your pocket? Understanding California's tax landscape is crucial for every worker, ensuring you can accurately budget, plan your financial future, and avoid any unwelcome surprises come tax season.

Navigating the world of paychecks can feel like traversing a maze, especially when factoring in the nuances of state and federal taxes. In California, this is particularly true, as the state boasts a progressive income tax system. This means the more you earn, the higher the percentage of your income that's subject to taxation. This can lead to confusion and uncertainty, especially when trying to estimate your net, or "take-home," pay. Thankfully, a variety of tools and resources are available to help you demystify the process and gain a clearer understanding of your finances.

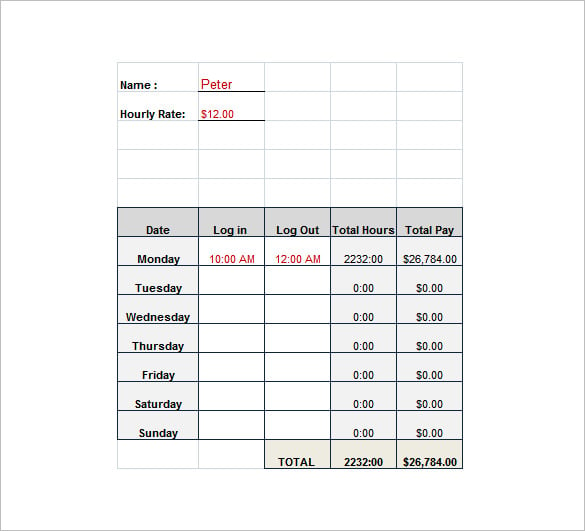

One of the primary tools at your disposal is the paycheck calculator. These online resources, often available for free, are designed to provide you with a clear and concise estimate of your net pay. By entering your gross income, tax withholdings, and other relevant information, such as marital status and the number of dependents, you can receive a detailed breakdown of your potential tax liability, including federal, state, social security, and Medicare deductions. This can be invaluable in helping you plan your budget, anticipate your monthly expenses, and make informed financial decisions.

California's tax system is more complex than in some other states. While some states like Alaska, Texas, Florida, Nevada, and Washington have no state income tax, California relies heavily on this revenue source. Its progressive tax structure means that the state income tax rates range from 1% to 12.3% as of 2025. This range highlights the importance of understanding how your income is taxed and how these deductions affect your overall take-home pay.

Here's a closer look at the factors influencing your California paycheck, and how to use the tools at your disposal to gain a clearer picture of your finances:

Understanding the Basics

- Nashville Man With Brain Exposed Whats The Story

- Donald Trumps Mic Drama Milwaukee Rally Sparks Outrage Amp Confusion

To accurately calculate your net pay, you first need to understand the elements that make up your gross pay. This includes your wages, any tips you may receive, bonuses, and any other form of compensation. Once you have this figure, you can begin to deduct various taxes and other withholdings to arrive at your net pay. California paycheck calculators are specifically designed to handle these complex calculations for you, estimating the taxes deducted from your earnings as an employee, including federal, California state, Social Security, and Medicare taxes.

Key Deductions

Several deductions will be taken from your gross pay before you receive your net pay. These typically include:

- Federal Income Tax: This is based on the federal tax brackets and your W-4 information (marital status, allowances, etc.).

- California State Income Tax: Calculated based on California's progressive tax rates.

- Social Security and Medicare Taxes: These are federal taxes that fund Social Security and Medicare programs.

- Other Deductions: This may include contributions to retirement plans (401(k)), health insurance premiums, and other voluntary deductions.

Using a Paycheck Calculator

Paycheck calculators, such as those found on websites like PaycheckCity and ADP, are designed to simplify the process. To use a California paycheck calculator, you'll typically need to input the following information:

- Gross Income: Your total earnings before any deductions.

- Pay Frequency: How often you get paid (weekly, bi-weekly, monthly, etc.).

- W-4 Information: Your filing status (single, married filing jointly, etc.) and any allowances you're claiming.

- California State Information: Similar information as your W-4, but specific to California tax laws.

- Additional Deductions: Retirement contributions, health insurance premiums, etc.

Once you've entered this information, the calculator will provide you with an estimate of your take-home pay, along with a breakdown of all the deductions.

Where to Find Reliable Paycheck Calculators

Several reputable websites offer free California paycheck calculators. Some of the most popular and reliable resources include:

- PaycheckCity: Provides a comprehensive suite of tools, including hourly paycheck calculators, withholding calculators, and payroll information.

- ADP: Offers a free tool to calculate net or "take home" pay for both hourly and salaried employees.

- SmartAsset: Their California paycheck calculator shows your hourly and salary income after federal, state, and local taxes.

Understanding the Results

The results generated by a paycheck calculator will typically include:

- Gross Pay: The total amount you earned during the pay period.

- Federal Income Tax Withheld: The estimated amount of federal income tax deducted from your paycheck.

- California State Income Tax Withheld: The estimated amount of California state income tax deducted.

- Social Security Tax Withheld: The amount deducted for Social Security taxes.

- Medicare Tax Withheld: The amount deducted for Medicare taxes.

- Other Deductions: Any other deductions you've specified (e.g., retirement contributions).

- Net Pay (Take-Home Pay): The amount of money you'll actually receive after all deductions.

Beyond the Calculator: Additional Considerations

While paycheck calculators are incredibly helpful, there are a few additional factors to consider when planning your finances:

- Tax Credits and Deductions: The calculator will estimate your tax liability based on the information you provide, but it won't factor in potential tax credits or deductions you may be eligible for. Tax credits can significantly reduce your tax liability.

- W-4 Accuracy: Ensure your W-4 information is accurate and up-to-date. Using the IRS Tax Withholding Estimator can help you determine the correct amount of tax to withhold from your paycheck.

- Tax Planning: Consider consulting with a tax professional to discuss strategies for minimizing your tax liability and maximizing your tax refunds.

- California's Unique Taxes and Deductions: Beyond income tax, California has other unique taxes and deductions, such as the State Disability Insurance (SDI) tax. Make sure to factor these into your calculations.

Example Scenario

Let's say you are a salaried employee in California earning $75,000 per year and paid bi-weekly. After entering your W-4 information (single, no dependents), the calculator would provide an estimated net pay per paycheck, detailing the federal income tax, California state income tax, Social Security, Medicare, and any other deductions, like a 401(k) contribution, that you might have.

Key Takeaways

In conclusion, taking control of your finances in California begins with a clear understanding of your paycheck. By utilizing free online resources like paycheck calculators, and by staying informed about the state's tax laws, you can gain valuable insights into your earnings and make more informed financial decisions. Whether you're an hourly or salaried employee, the ability to estimate your take-home pay is a vital tool for budgeting, saving, and achieving your financial goals.

Important Note: Tax laws and regulations are subject to change. While online paycheck calculators are generally accurate, it's always advisable to consult with a tax professional for personalized advice and to ensure compliance with the latest tax laws.

Detail Author:

- Name : Kacey Sipes DVM

- Username : orin.mcclure

- Email : gerhold.marquise@becker.com

- Birthdate : 1989-10-20

- Address : 77385 Emmerich Bridge Suite 016 Ritchieberg, AL 70714

- Phone : 1-419-755-5242

- Company : Kuhn, Barrows and Kub

- Job : Electrical Parts Reconditioner

- Bio : Unde deserunt qui iusto voluptatibus veniam accusantium dolorem non. Voluptatum distinctio odio vero et suscipit sit id alias.

Socials

linkedin:

- url : https://linkedin.com/in/tina1420

- username : tina1420

- bio : Quae rerum aut et ullam excepturi non cumque.

- followers : 3310

- following : 1314

twitter:

- url : https://twitter.com/koelpin2005

- username : koelpin2005

- bio : Quasi qui in asperiores aut ipsa ducimus qui earum. Et fugiat nobis saepe sunt voluptas eos deleniti totam. Enim voluptates libero rem repellendus sit.

- followers : 6051

- following : 487

facebook:

- url : https://facebook.com/tina_official

- username : tina_official

- bio : Eum quidem minus eveniet quam tenetur enim. Et et sit porro animi.

- followers : 4369

- following : 154

instagram:

- url : https://instagram.com/tinakoelpin

- username : tinakoelpin

- bio : Ratione dolores consectetur explicabo debitis. Esse ut eos porro voluptates. Quis eveniet et est.

- followers : 2005

- following : 1607